Identity theft on the rise in Minnesota and Iowa

(ABC 6 News) – It can happen to anyone, identity theft. Experts say they’ve seen an increase in it in both Minnesota and Iowa. It can happen for a number of reasons and one of the most common sources of theft is credit card fraud. It can happen any time but you’ll want to be extra careful when doing your holiday shopping online this year.

“Many of us receive those calls on our cell phones saying that somebody needs money or somebody needs their social security number,” said Patrol Lt. Ryan Lodermeier with the Rochester Police Department.

Those phone calls are just part of the reason identity theft is on the rise. In a new study, experts at LendingTree say it has gone up 125% in Minnesota and 106.3% in Iowa since 2019.

“Of course during the pandemic, that really accelerated” explained Rob Bhatt, an Analyst at LendingTree.

“And a couple of things that accompanied that, we had a lot of government programs available. The bad guys figured out how to divert those funds to people that were in need.”

A bad move Patrol Lt. Lodermeier says can lead to criminal consequences.

“There are criminal statutes out there in which people can be penalized.”

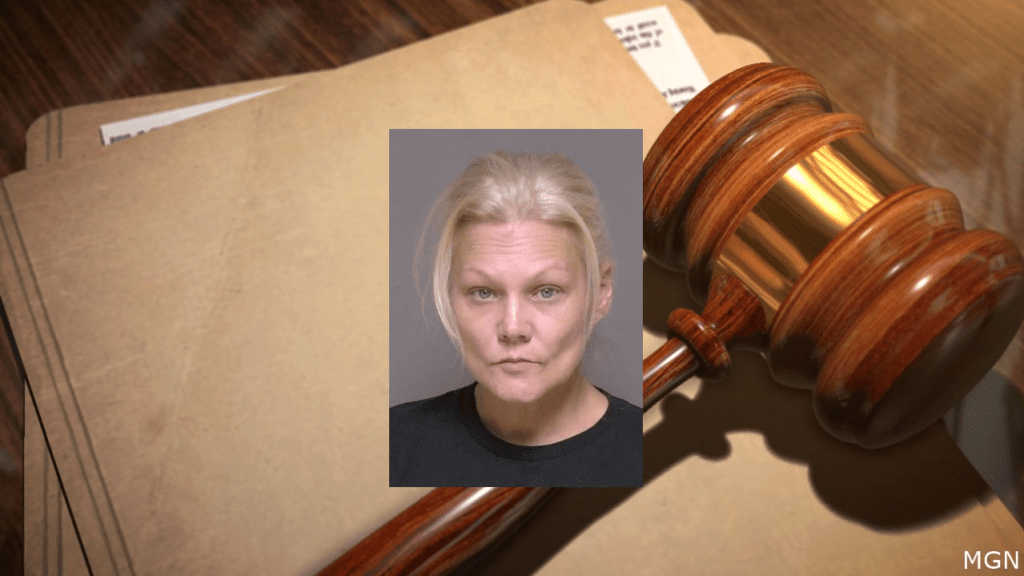

Just this week, Connie Ziemann of Rochester allegedly stole a former customer’s wallet and tried to open a line of credit. Jennifer Cruz Dickens of Albert Lea has been charged with felony check forgery and two counts of identity theft dating back to last fall.

Related: Albert Lea woman appears in court on 2022 identity theft charges

“The challenging thing when it comes to law enforcement is prosecution for it. Identifying the person who is doing the scamming and many times if we can identify them, they’re not within our community. They’re either out of state or out of the country which makes prosecution extremely difficult,” added Lodermeier.

Related: How to spot 4 Social Security scams and protect your identity

Difficult to catch the ones behind the crime and for victims to turn things around as Lodermeier explains.

“The first thing they want to do is certainly make a police report here with the police department. If you go to, for example, the Social Security Administration and say my social security has been compromised, they’re going to want some documentation to back that up and unfortunately from there, it’s kind of a slower process to get things restored.”

There are plenty of ways to keep yourself from becoming a victim. A few tips include looking closely at emails to make sure they’re not phishy. Know that most companies won’t ask for certain private information over the phone. Also, be careful when you are doing that online shopping.

Related: What the Tech? Scams for All Ages

“Generally avoid transactions using a public internet line. Public wifi I should say. Those are opportunities for hackers to get your data,” added Bhatt.

Another tip is to be wary of any deal that seems too good to be true. For those emails you get with coupons, take a closer look and keep that promo code handy. You might have to do your own investigating to figure out if it’s real or not.