Rochester business owner accused of tax crimes

(ABC 6 News) — A business owner is facing a slew of charges after police say he operated an after-hours nightclub without paying thousands of dollars in taxes.

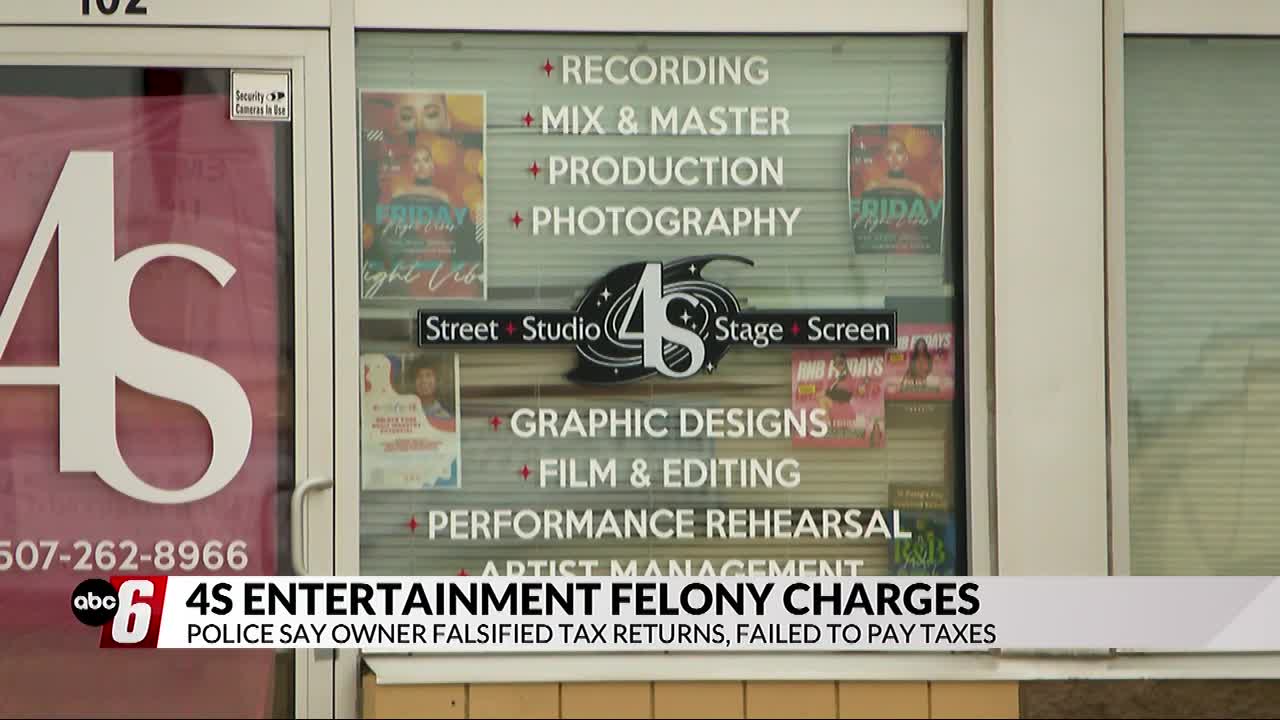

The owner of 4S Entertainment is facing nine felony charges for falsifying tax returns and failing to pay correct tax amounts.

Police say a 2023 investigation from RPD and state departments uncovered owner Donyale Gayles-Johnson operated a nightclub after hours without a license. The nightclub was open from 2 a.m. to 5 a.m. Friday and Saturdays, according to police.

Court documents also show Gayles-Johnson under-reported income from his business and is now facing nine felony charges for tax violations. Accountant Bill Oertli said Minnesota isn’t the only problem Gayles-Johnson has.

“He’s going to have some problems with the IRS as well,” Oertli said.

“They have a working agreement where the state notifies the federal government, so even they could be brought in yet.”

Neighboring business owners said they didn’t see the nightclub since it operated after business hours. Gayles-Johnson has his first court appearance on July 9th.

Gayles-Johnson did not respond to ABC 6 News for comment at the time of publication.

Previous story: (ABC 6 News) – The owner of a Rochester business is facing several felony charges for tax violations.

According to the Rochester Police Department, an investigation found that Donyale Gayles-Johnson, owner of 4S Entertainment (located at 3160 Wellner Dr. NW, Suite, 200, Rochester), was operating an after-hours nightclub without a license.

Between 2019 and 2023, Gayles-Johnson allegedly failed to pay state and local sales tax on liquor sales and cover charges.

The investigation also found that the owner allegedly under-reported income from the business.

According to the complaint, it is estimated that [Gayles-Johnson] owes the State of Minnesota an estimated $7,967.68 in sales and use tax, penalty, and interest for these years of $32,340.27 in income tax, penalties, and interest.

The owner faces four counts of filing false or fraudulent tax returns and five counts of failing to pay or collect taxes. Each count carries a maximum sentence of five years in prison, a $10,000 fine, or both.