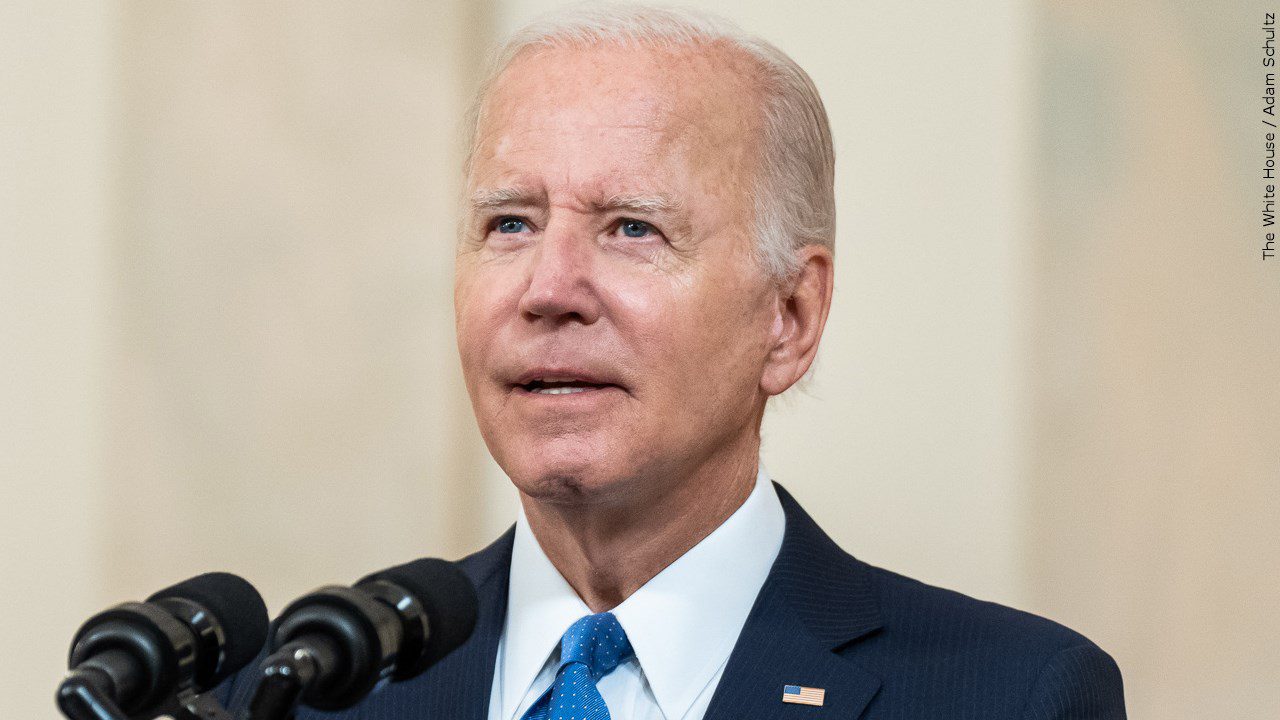

Biden announces long-awaited student debt forgiveness plan

Courtesy: MGN / The White House / Adam Schultz

WASHINGTON (AP) — President Joe Biden on Wednesday announced his long-awaited plan to deliver on his campaign promise to provide $10,000 in debt cancellation for millions of Americans — and up to $10,000 more for those with the greatest financial need.

Borrowers who earn less than $125,000 a year, or families earning less than $250,000, would be eligible for the $10,000 loan forgiveness, Biden announced in a tweet. For recipients of Pell Grants, which are reserved for undergraduates with the most significant financial need, the federal government would cancel up to an additional $10,000 in federal loan debt.

Biden is also extending a pause on federal student loan payments for what he called the “final time” through the end of 2022. He was set to deliver remarks Wednesday afternoon at the White House to unveil his proposal to the public.

If his plan survives legal challenges that are almost certain to come, it could offer a windfall to a swath of the nation in the run-up to this fall’s midterm elections. More than 43 million people have federal student debt, with an average balance of $37,667, according to federal data. Nearly a third of borrowers owe less than $10,000, and about half owe less than $20,000. The White House estimates that Biden’s announcement would erase the federal student debt of about 20 million people.

Proponents say cancellation will narrow the racial wealth gap — Black students are more likely to borrow federal student loans and at higher amounts than others. Four years after earning bachelor’s degrees, Black borrowers owe an average of nearly $25,000 more than their white peers, according to a Brookings Institution study.

Still, the action is unlikely to thrill any of the factions that have been jostling for influence as Biden weighs how much to cancel and for whom.

Biden has faced pressure from liberals to provide broader relief to hard-hit borrowers, and from moderates and Republicans questioning the fairness of any widespread forgiveness. The delay in Biden’s decision has only heightened the anticipation for what his own aides acknowledge represents a political no-win situation. The people spoke on the condition of anonymity to discuss Biden’s intended announcement ahead of time.

The continuation of the coronavirus pandemic-era payment freeze comes just days before millions of Americans were set to find out when their next student loan bills will be due. This is the closest the administration has come to hitting the end of the payment freeze extension, with the current pause set to end Aug. 31.

Details of the plan have been kept closely guarded as Biden weighed his options. The administration said Wednesday the Education Department will release information in the coming weeks for eligible borrowers to sign up for debt relief. Cancellation for some would be automatic, if the department has access to to their income information, but others would need to fill out a form.

Current students would only be eligible for relief if their loans were originated before July 1, 2022. Biden is also set to propose capping the amount that borrowers pay monthly on undergraduate loans at 5% of their earnings.