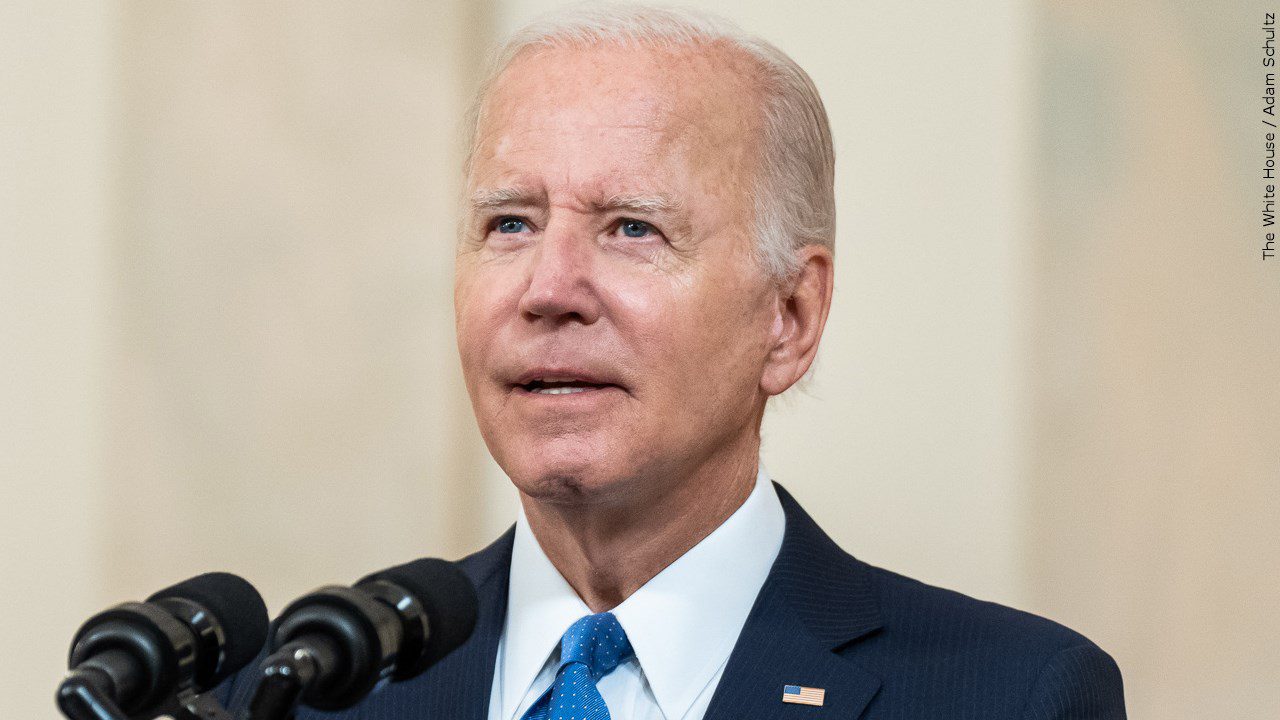

Pres. Biden delivered remarks Monday on banking system following failures of two big banks

Courtesy: MGN / The White House / Adam Schultz

(ABC 6 News) – President Joe Biden delivered remarks Monday morning in an effort to reassure Americans there is no need for panic after federal agencies stepped in following the failures of two big banks.

“Americans can have confidence that the banking system is safe. Your deposits will be there when you need them,” Biden said from the White House.

The federal government said over the weekend that all depositors at Silicon Valley Bank and Signature Bank will be protected and get access to their money Monday morning, with the funds coming from special fund set up by the nation’s banks and from the sale of the banks’ assets, not from taxpayers.

“No losses will be borne by the taxpayers,” Biden repeated.

Pres. Biden issued a statement on Sunday regarding actions to strengthen confidence in the banking system saying:

“Over the weekend, and at my direction, the Treasury Secretary and my National Economic Council Director worked diligently with the banking regulators to address problems at Silicon Valley Bank and Signature Bank. I am pleased that they reached a prompt solution that protects American workers and small businesses, and keeps our financial system safe. The solution also ensures that taxpayer dollars are not put at risk.

The American people and American businesses can have confidence that their bank deposits will be there when they need them.

I am firmly committed to holding those responsible for this mess fully accountable and to continuing our efforts to strengthen oversight and regulation of larger banks so that we are not in this position again.

Monday’s remarks were set to focus on “how we will maintain a resilient banking system to protect our historic economic recovery.”

The news comes after governments in the U.S. and Britain are taking extraordinary steps to prevent a potential banking crisis after the failure of California-based Silicon Valley Bank prompted fears of a broader upheaval.

RELATED: US, UK try to stem fallout from Silicon Valley Bank collapse

Regulators in the U.S. rushed to close Silicon Valley Bank on Friday when it experienced a traditional bank run, where depositors rushed to withdraw their funds all at once. It is the second-largest bank failure in U.S. history, behind only the 2008 failure of Washington Mutual.